Trial lawyers are at a disadvantage when it comes to getting paid. It’s a familiar scenario: after obtaining a settlement or jury verdict, an attorney collects a 33 to 40 percent contingency fee from the award. And sure, it sounds like a great problem to have. But having earned a substantial contingency fee or even multiple fees over the course of the year can mean paying far more in federal and state taxes and possibly moving into a higher tax bracket—resulting in an even bigger tax burden. Earning a big fee then becomes more Uncle Sam’s cause for celebration than anything else.

Since 1994, many attorneys earning contingency fees have legally circumvented this issue with a savvy tax planning strategy that’s available only to them—something that CEOs, athletes and other high-income earners likely wish they could use. In Richard A. Childs, et al. v Commissioner of Internal Revenue, the 11th Circuit U.S. Court of Appeals ruled that any attorneys involved in tort cases under contingency fee agreements may receive their fees in the form of periodic payments instead of in one lump sum. The IRS then followed up with comprehensive tax guidance for attorneys who defer their fees, namely in Notice 2005-1 and Private Letter Ruling 150850-07.

Commonly called attorney fee deferral or fee structure, this arrangement allows attorneys to receive smaller, incremental payments from their fees over time – helping them remain in a lower tax bracket and spreading the tax responsibility over time. Deferral is fully customizable. It is meant to meet attorneys where they are as individuals and where they want to go—considering their tax situation, family’s needs, professional growth and overall short- and long-term financial goals. A portion of the fee can be taken upfront, and the rest can go into an investment account or annuity. Or, the entire fee can be deferred.

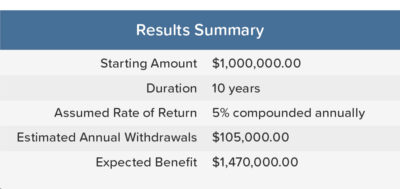

Here’s a real-world scenario (see chart at left). Meredith was about to earn a $1 million fee from a successful personal injury case. However, receiving it all at once would send her into a higher tax bracket. Instead of receiving the $1 million in a lump sum, Meredith chose to receive $105,000 annually for ten years, beginning on June 1, 2025. Her strategy features a blend of market equities and fixed income designed to take advantage of large market-based asset allocation shifts. Not only did this periodic payment plan allow her to strategize around tax season and better prepare financially for the future, but with an assumed rate of return of five percent compounded annually, Meredith also benefits from the growth on her earnings over time.

Here’s a real-world scenario (see chart at left). Meredith was about to earn a $1 million fee from a successful personal injury case. However, receiving it all at once would send her into a higher tax bracket. Instead of receiving the $1 million in a lump sum, Meredith chose to receive $105,000 annually for ten years, beginning on June 1, 2025. Her strategy features a blend of market equities and fixed income designed to take advantage of large market-based asset allocation shifts. Not only did this periodic payment plan allow her to strategize around tax season and better prepare financially for the future, but with an assumed rate of return of five percent compounded annually, Meredith also benefits from the growth on her earnings over time.

Attorneys can defer any contingency fee from a physical or non-physical injury tort settlement. They must elect to defer all or some of their fees prior to executing a release, as a fee deferral must be predetermined and finite. Considering an individual’s calendar year revenue, the best course of action is first to establish a qualified settlement fund. Also known as a 486(b) trust, a qualified settlement fund collects the defendant’s full payment of a settlement or jury verdict award and holds the funds past the conclusion of the case. Plaintiffs may then take the extra time to explore their own financial planning options, and attorneys can consider their fee deferral options—all without the pressure of the impending end of litigation.

If a fee is placed into a qualified settlement fund, the attorney has time and less pressure to decide on the right payment options, because there is usually no immediate time frame to distribute the funds. On the other hand, if the fee is coming directly from the defendants and/or their insurers, a deferral plan must be in place prior to settlement. In mass tort litigation, class actions and individual actions, attorneys can defer their contingency fees as long as a qualified settlement fund is established before the release is executed.

When deciding whether now is the right time to incorporate fee deferral into an overall wealth management strategy, attorneys should consider their current financial needs and those of their firm, as well as their savings goals, tax situation and how distributing their fee as payments, would help them plan for a secure financial future.

Controlling the receipt of income allows attorneys to plan smarter for each tax season as well as for life’s milestones and goals. Many attorneys use fee deferral strategies to enhance their retirement plan; they work especially well alongside a 401k, a stock portfolio and/or any other investments. Other attorneys apply their periodic payments to cover their kids’ college tuition or facilitate their firm’s growth. No matter the individual’s unique needs, deferring contingency fees is an important consideration for attorneys wanting to plan long-term with their earnings strategically.

Leave A Comment